Case Studies

╼ Case Studies

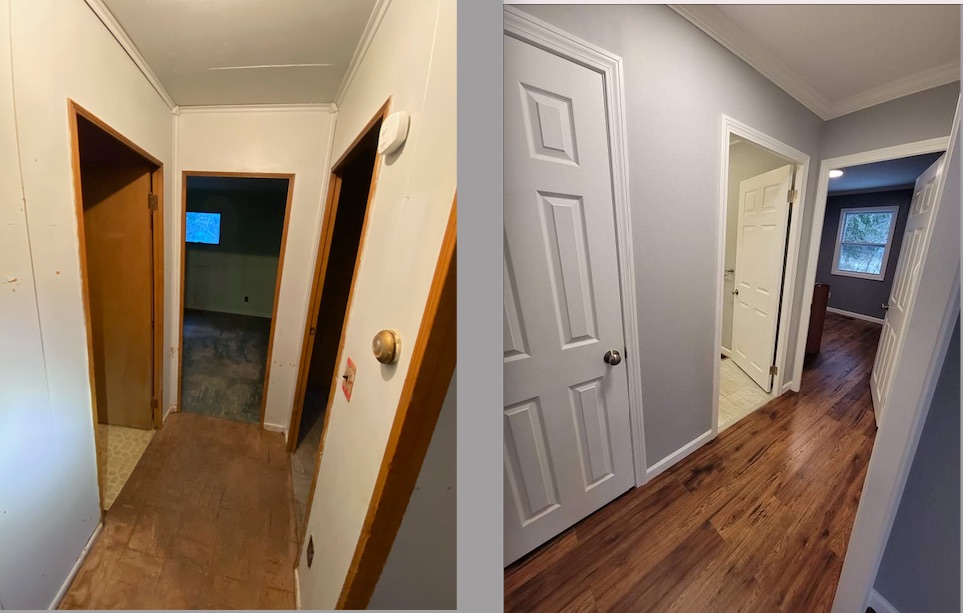

Growing Business Faster with BRRRR

A repeat private investor client wanted to purchase a small 2 bedroom / 1 bathroom single family home in need of extensive renovation. The rehabilitation budget was roughly equal to the home purchase price. The investor had the capital to purchase the home in cash and self-finance the renovation,

Read More

but it would have exhausted his liquidity and limited the growth of his business.

M.R. Qualified lent 70% of the initial purchase price and funded construction reimbursements for 50% of

improvements to the property.

The property was fully renovated in 6 months, and the investor was able to make several other real estate investments during this time, using low cost, long-term bank financing. Ten months after closing, the investor repaid M.R. Qualified, and he was able to take cash out of the property by renting it to a long-term tenant and completing a money-out refinancing with a traditional bank loan.

╼ Case Studies

Young Investor Fix & Flip

A recent college graduate with a keen interest in real estate wanted to flip a duplex. The aspiring investor had successfully completed several wholesale deals, but this would be his first acquisition. He was able to produce comparable property sales demonstrating that the subject property was below market on both a purchase and after renovation value basis.

Read More

The client’s means were limited but academic and extra-curricular credentials were strong.

He had a good credit score and clean background check. The client was also willing to put up virtually all of his net worth to fund the project, and contribute sweat equity by contributing labor by himself and a close family member experienced in construction trades.

M.R. Qualified funded over 90% LTV on the purchase price, and provided construction reimbursements on materials costs. The client kept M.R. Qualified informed throughout the renovation process, and several budget revisions were approved without fees or added expense. The property was fully renovated in four months and successfully marketed for sale on the MLS. The client made over $100,000 (4x his initial investment) after paying all carrying costs, renovation expenses and loan fees and expenses.

╼ Case Studies

Fast Fix & Flip

A new private investor client heard about an off-market sale through a wholesaler. The sale had to be completed within ten days to allow the seller to avoid impending bank fees.

The client contacted a reputable real estate agent in the target market and was able to complete a comparable market analysis showing that the after-fee wholesale price was well-below market, and only very light cosmetic renovations were needed.

Read More

M.R. Qualified worked with the investor’s title company to quickly review and sign off on a title commitment.

Loan documents were drafted and M.R. Qualified closed within nine days of initial contact, lending 80% of the purchase price. Cosmetic renovations were completed in a single weekend, and the property was listed for sale on the MLS in less than one week. The property sold in 53 days, and the investor client made over 150% total return on his investment.

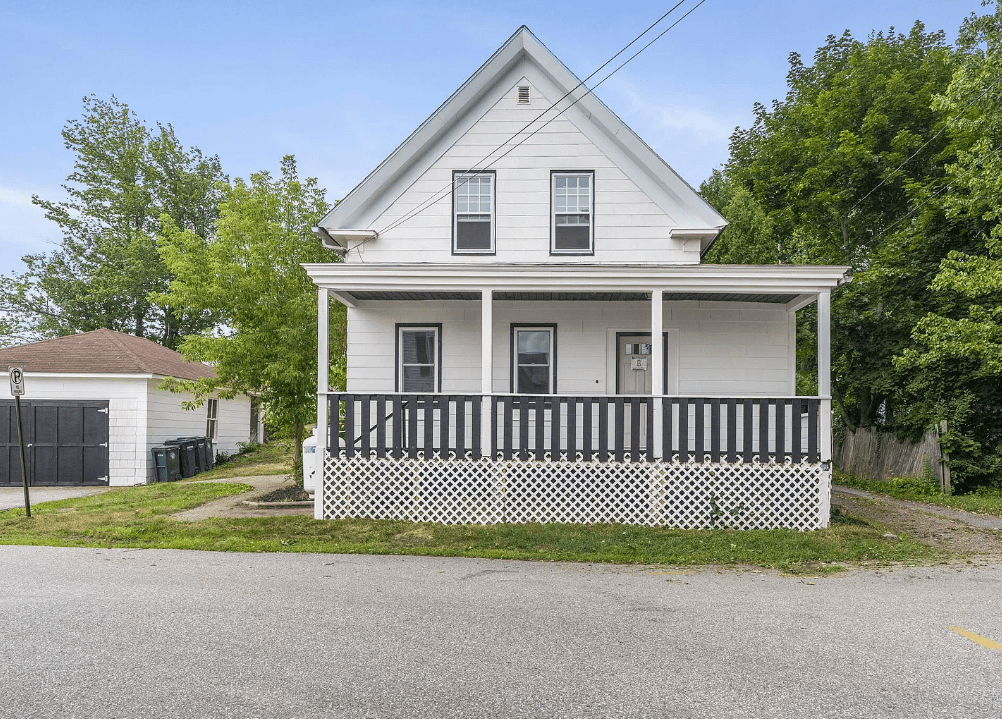

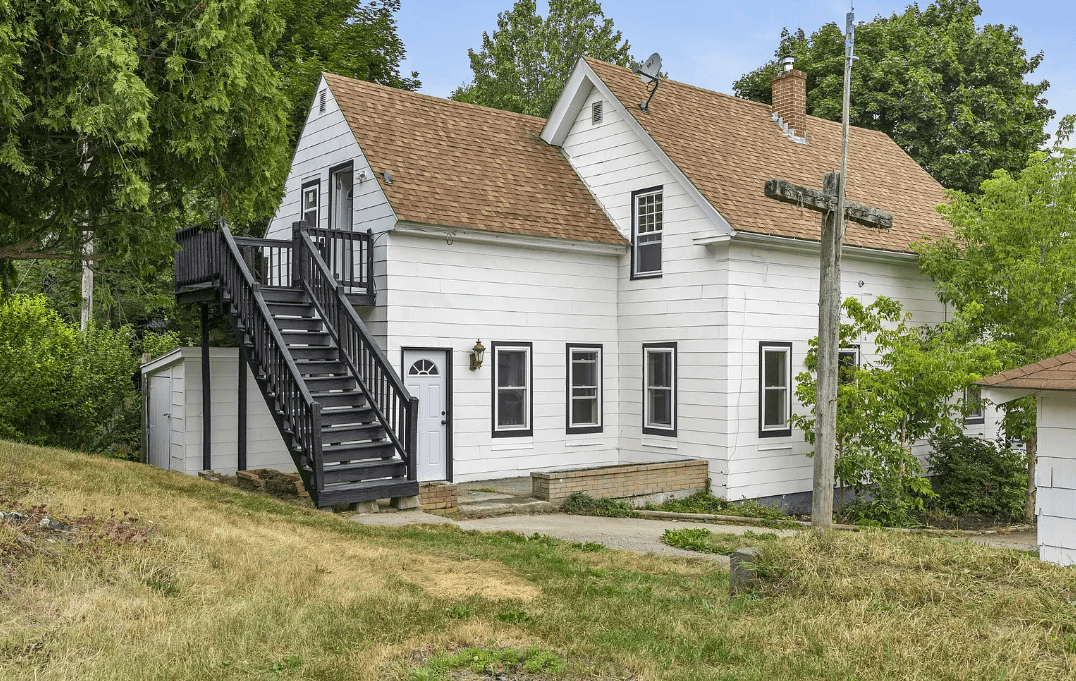

BRRRR via Rent Adjustment

A private investor with deep ties in central Maine’s commercial real estate community wanted to purchase a portfolio of properties in Auburn, Maine with below market rents. Most leases were in month-to-month / tenant-at-will status, and the investor planned to make modest building improvements. To facilitate the purchase transaction, the investor sought and obtained short-term bridge financing from M.R. Qualified.

Read More

Second Lien PIK Note

Read More

36-Hour Turnaround

Read More