╼ Welcome

╼ Private Financing

Why Use Private Financing?

- As real estate entrepreneurs grow their business, they often encounter challenges working with traditional banks and credit unions. These include:

- Unwillingness to lend against collateral needing intensive rehabilitation

- Lending officers who fail to understand investor’s tax returns

- High or accelerated depreciation losses

- High expenses from property rehabilitation

- Low or lack of 1099 or W2 income

- Rental income that is in-place but not yet reported on past year’s tax returns

╼ Resources

Client Resources

Step 1: Apply

Complete the personal financial statement (PFS)

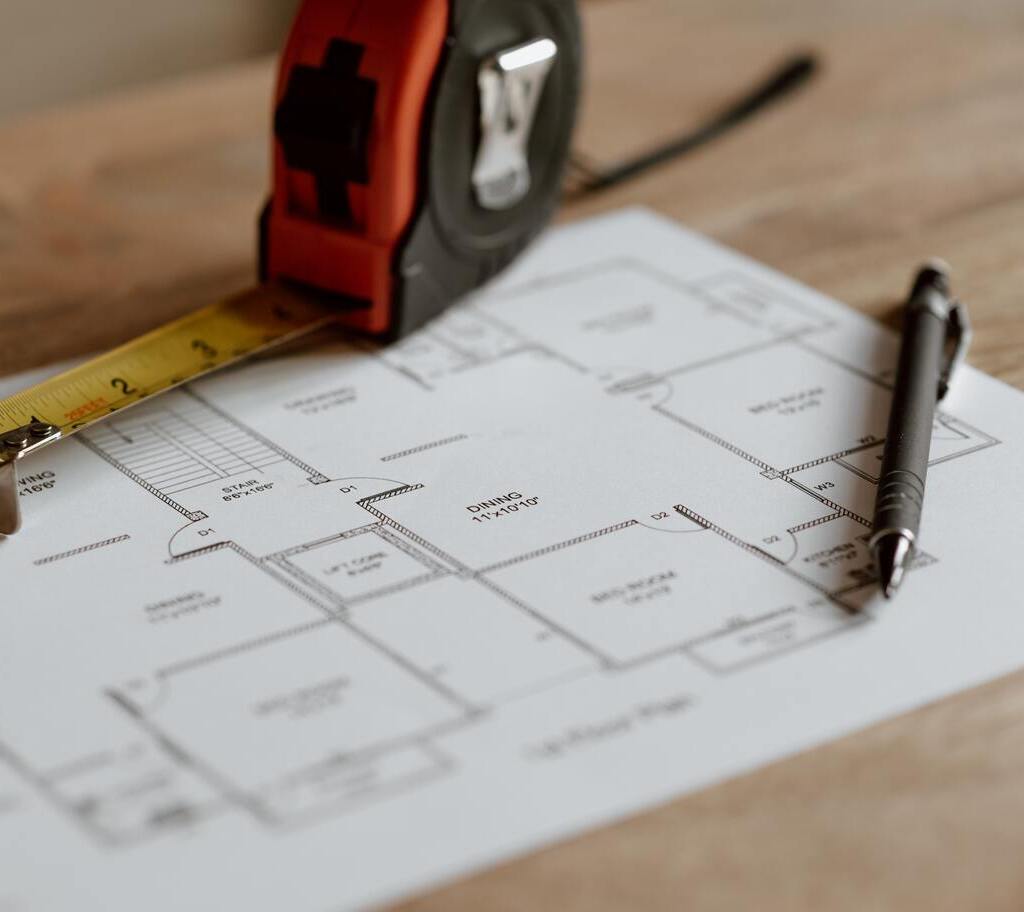

Provide an overview of the investment opportunity / subject property, comparable market analysis or brokers opinion of value, rehab budget, if applicable

Initial interview (20-30 mins)

Step 2: Diligence

Additional diligence requests

M.R. Qualified provides a non-binding term sheet

Step 3: Documentation

M.R. Qualified drafts loan documents

Borrower engages title company to complete title review and issue a title insurance policy

Borrower obtains property / casualty insurance

Step 4: Closing

Closing